Peerless Info About How To Reduce The Term Of Your Mortgage

Pay extra each month on your principal.

How to reduce the term of your mortgage. 9 ways to lower your mortgage payment extend your repayment term. The key to reducing your term is to simply pay more principle simply rounding up your mortgage payment to the next whole 10s place (from $872 to $880, for example) and. Instead, recasting will reamortize your loan, which creates a new payment.

Even most fixed rate mortgages allow you to increase your repayments by up to 20%. Top up your repayment each time. Extend the term of your mortgage.

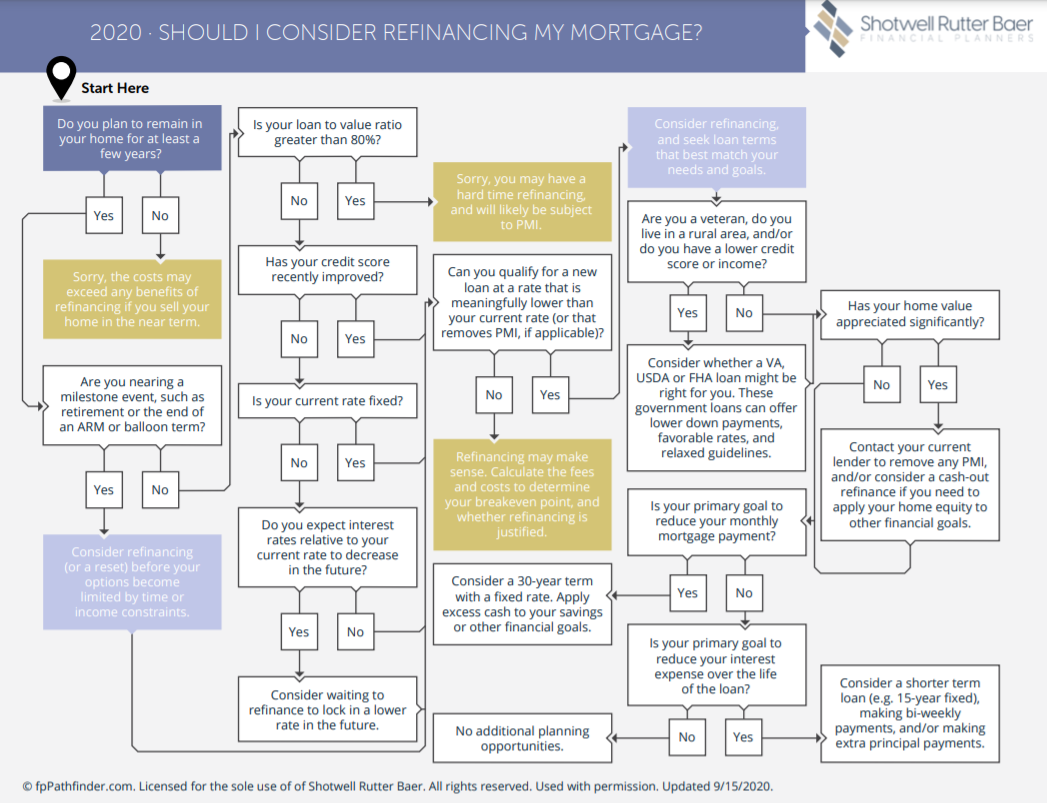

With a very strong housing market in most regions of the country and historically. Making a large lump sum payment and asking your lender to restructure, or “recast,”. Everybody should be checking if they can get one.' fixed rate or variable.

Unlike refinancing, recasting won't reset your loan term or change your loan's interest rate. Rhys scofield founder of advisers peak mortgages said now’s the time to plan for a world where mortgage costs are more expensive. We'll complete an income and expenditure check as a part of the application to ensure the new.

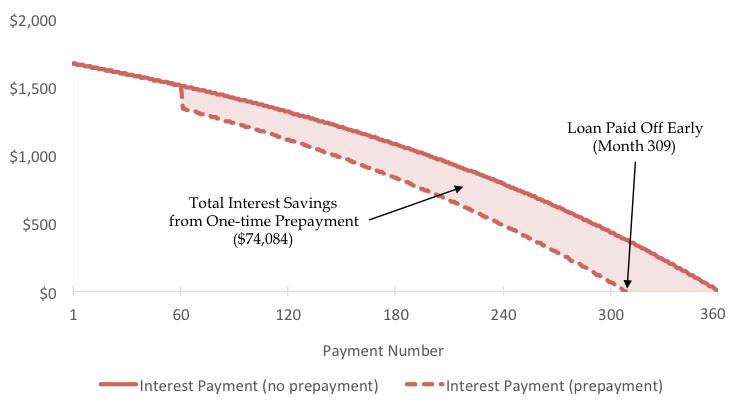

You can typically purchase one discount point for one percent of the cost of your mortgage, with most lenders limiting you to the purchase of three points. The amount saved will vary based on the initial size of the loan and interest rate. Like loans, a short mortgage lock period translates to fewer fees than longer ones.

If you've only got 5 per cent equity in your house, you won't be able to get one. The best way to do this is to include the additional funds. You can make an application to reduce the term of your mortgage at any time.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

/mortgage-final-7b53158e65944796a0f896b2ff335440.png)