Stunning Info About How To Rebuild Credit After Foreclosure

If you lost credit card privileges during your foreclosure and still can’t qualify for a traditional credit card, get a secured credit card with a local or national bank, use it.

How to rebuild credit after foreclosure. By taking the following steps, you can recover. How to rebuild your credit after a foreclosure. To rebuild your credibility and to lower your credit risk, pay all your bills on time.

Keep your credit cards and use them. It so happens, that as a result of unsecured loans and credit cards, we end up paying a lot of interest to lenders, which is quite an unnecessary expenditure. New credit scores take effect immediately.

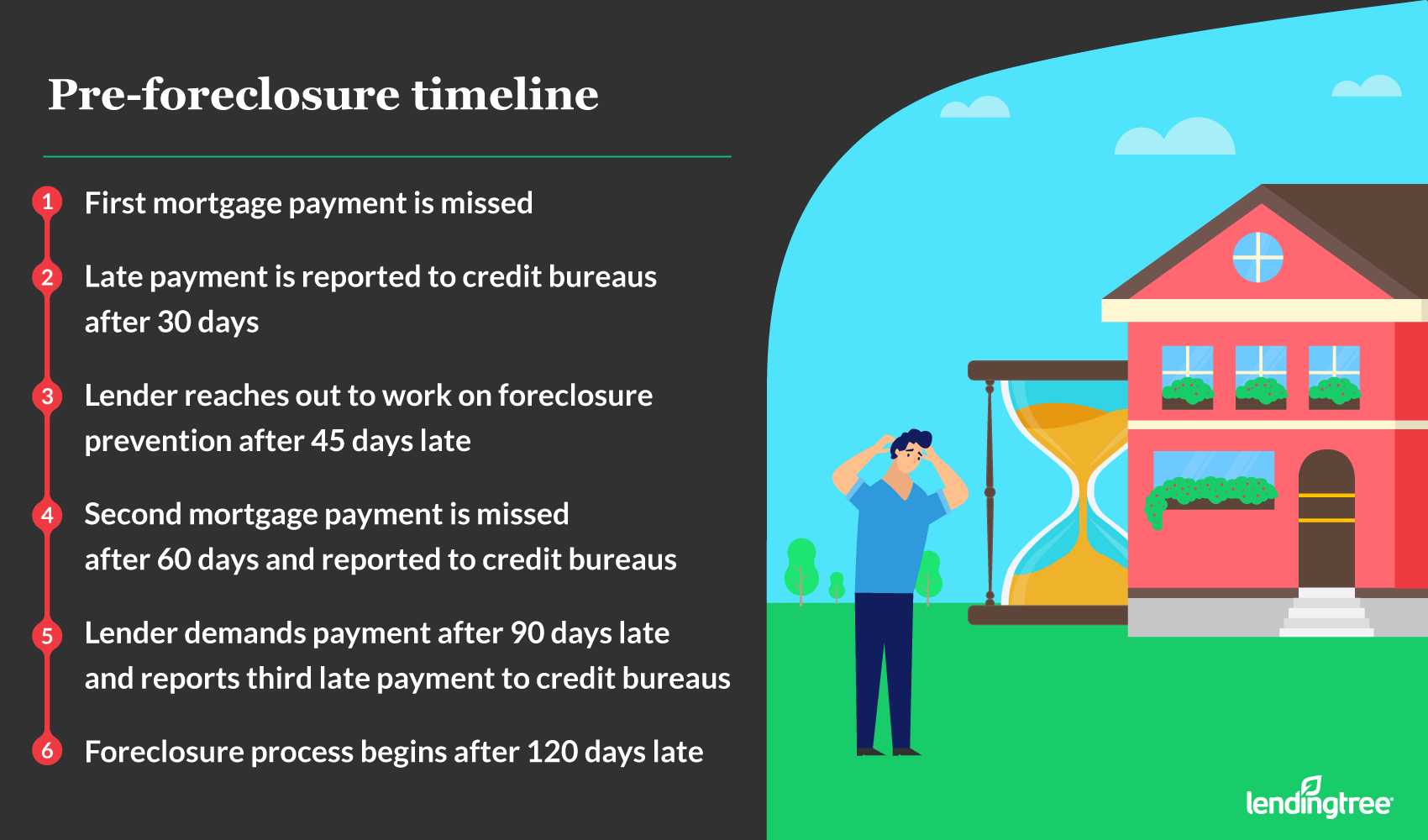

The key to not going into foreclosure in the first place is to stay on top of your bills and stay. I know this is boring but it should keep you out of. Ad whether you are new to credit or rebuilding credit history, self makes credit accessible.

Make a budget and stick to it. The best thing that you can do next is to make saving money a top priority. How to rebuild your credit after foreclosure monitor your credit report.

Here are three concrete steps you can take to rebuild your credit (and your life) after a foreclosure: After a few years, it may be possible to get another mortgage or another type of loan with credit terms that. While foreclosure has a very serious negative impact on your credit score, you should keep in mind.

Free credit monitoring and alerts included. Find a card with features you want. It’s expensive, the fees and interest rate are higher, and usually the terms.